Income tax - Work to adapt housing to the loss of autonomy related to age or disability (tax credit)

Verified 01 January 2026 - Public Service / Directorate of Legal and Administrative Information (Prime Minister)

Income tax: 2026 income tax return for 2025

This page is up to date at 1er January 2026.

However, forms, online services and information materials are not yet available for the 2026 tax year of the 2025 tax return. They will be put online as soon as they are available.

In addition, the draft budget law for 2026 could not be promulgated before 1er January 2026.

The law n°2025-1316 of 26 december 2025 The Special Authorizes the Government to Collect Taxes, Without Modifying the Scales, Until the Adoption of a Budget Law for 2026.

If the Finance Law for 2026 changes the rules presented on this page, the content will be updated after the publication of the Finance Law in the Official Journal.

Do you want to have equipment work done in your home for people with disabilities or elderly people who are losing their autonomy? You can benefit, under conditions, from a tax credit. We tell you what you need to know about your 2025 expenses to report in 2026.

The tax credit for adapting housing to age or disability is placed under resource conditions (for expenses paid since 1er January 2024).

It is reserved for middle-income earners, who meet certain conditions.

FYI

If your income is modest or very modest, you must apply for new premium MaPrimeAdapt'. You cannot benefit from both the tax credit and the new premium.

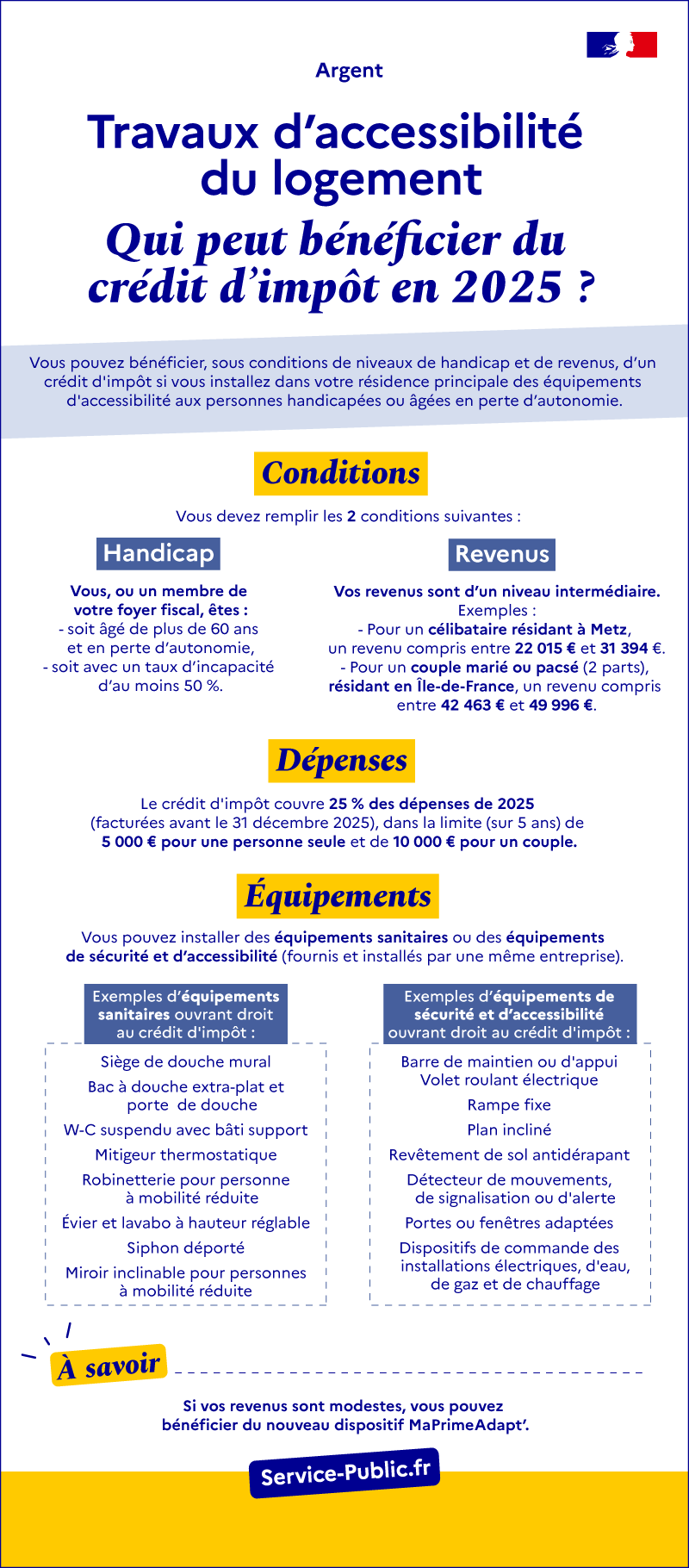

Infographie - Housing accessibility work: who can benefit from the tax credit?

Ouvrir l’image dans une nouvelle fenêtre

Title: Housing accessibility works: who can benefit from the tax credit in 2025?

You can benefit, under conditions of disability levels and income, from a tax credit if you settle in your main residence facilities for disabled or elderly persons with loss of autonomy.

Conditions

You must meet the following 2 conditions:

1/ Disability

You, or a member of your tax household, are either over 60 years of age and losing autonomy, or with a disability rate of at least 50%.

2/ Income

Your income is at an intermediate level.

Examples:

For a single person residing in Metz: an income between 22 015 € and 31 394 €.

For a married couple residing in Île-de-France: an income between €42,463 and €49,996.

Expenditure

The tax credit covers 25% of 2025 expenses (billed before December 31, 2025), up to a limit (over 5 years) of €5,000 for a single person and €10,000 for a couple.

Equipment

You can settle sanitary equipment or safety and accessibility equipment (provided and settled by the same company).

Examples of sanitary equipment eligible for the tax credit:

- Wall-mounted shower seat

- Extra-flat shower tray and shower door

- Suspended W-C with support frame

- Thermostatic mixer

- Taps for people with reduced mobility

- Height-adjustable sink and washbasin

- Siphon deported

- Tilting mirror for people with reduced mobility

Examples of security and accessibility equipment eligible for the tax credit:

- Holding or support bar

- Electric roller shutter

- Fixed ramp

- Inclined plane

- Non-slip flooring

- Motion, signaling or alert detector

- Adapted doors or windows

- Control devices for electrical, water, gas and heating installations

Namely: If your income is modest, you can benefit from the new MaPrimeAdapt' device.

Accommodation

You must be tax domiciled in France and this accommodation must be your main dwelling.

You can own, rent or occupy the property for free.

You must have work done in your accommodation.

If you are a tenant, you must ask your landlord's prior authorization.

If you live in a collective building, in which work has been done on common equipment, you benefit from the tax credit for your share of expenses.

Warning

The work must be carried out by the same company.

Persons concerned

To benefit from the tax credit, you, or a member of your tax home, must be in one of the following situations:

- Aged 60 years or older and with a loss of autonomy that classifies you in one of groups 1 to 4 of the applicable national grid for personalized autonomy allocation

- With a disability rate greater than or equal to 50% (rate determined by decision of the CDAPH: titleContent).

You must also fill in income conditions.

Your household's annual income must be superior the following income:

Number of persons in the household | Revenues Île-de-France | Income other regions |

|---|---|---|

1 | €28,933 | €22,015 |

2 | €42,463 | €32,197 |

3 | €51,000 | €38,719 |

4 | €59,549 | €45,234 |

5 | €68,123 | €51,775 |

Per additional person | €8,568 | €6,525 |

Please note

If your 2023 income is less than or equal to these thresholds, your 2024 income is withheld.

Your annual income must also be below ceilings calculated based on the number of shares in your tax home.

Revenue caps are calculated as follows:

- €31,394 for the 1re family quotient share

- €9,301 for each of the following 2 half-shares

- €6,976 for each additional half-share from 3e.

Please note

If your 2023 income is greater than or equal to these limits, your 2024 income is withheld.

Example :

For a married or past couple (2 shares) resident in Île-de-France.

The minimum income for the tax credit is €42,463.

The income not to be exceeded in order to benefit from it is: €31,394 + (€9,301 x 2) = €49,996.

The couple's annual income must be between €42,463 and €49,996.

Example :

For one person single (1 share) resident in Metz.

The minimum income for the tax credit is €22,015.

The income not to be exceeded in order to benefit from it is €31,394.

The income of the single person must be between €22,015 and €31,394.

Date of work

The work must be done and invoiced before 31 December 2025.

The payment of a down payment, in particular when the quotation is accepted, is not considered as a payment for the tax credit.

Payment is considered to have taken place at the time of final payment of the invoice.

Example :

You paid a deposit in 2024.

The invoice was issued in December 2024 and you paid the balance in January 2025.

The tax credit is available for the taxation of your 2025 income (return in 2026), for all expenses incurred.

If you are in a condominium and the work is paid for through the trustee, the date taken into account is the date of payment of the amount of the work to the company that carried it out.

It's not the date of your calls for funds.

You must have your accommodation housing adaptation works loss of autonomy or disability.

The installation and replacement of the equipment are concerned.

You must have settled in your accommodation one or more equipment of the following categories:

- Sanitary equipment

- Safety and accessibility equipment.

The equipment concerned is as follows:

Répondez aux questions successives et les réponses s’afficheront automatiquement

Sanitary equipment

- Height-adjustable sink and washbasin

- Sink and fixed washbasin usable by a person with reduced mobility

- Siphon deported

- Wall-mounted shower seat

- Full shower cubicle for people with reduced mobility

- Extra-flat shower tray and shower door

- Tiled shower tray

- Lifting pump or water suction pump for extra-flat receiver

- Raised W-C

- Suspended W-C with support frame

- W-C equipped with a washing and drying system

- Taps for people with reduced mobility

- Thermostatic mixer

- Tilting mirror for people with reduced mobility.

Safety and accessibility equipment

- Holding or support bar

- Handrail

- Motorization system for shutters, entrance and garage doors, gate

- Electric roller shutter

- Control system comprising a motion, signaling or warning detector

- Device for closing, opening or controlling electrical, water, gas and heating installations

- Timed lighting coupled to a motion detector

- Adapted door pull handle or bar

- Residential transfer system or ceiling bracket

- Fixed ramp

- Inclined plane

- Height-adjustable furniture

- Podotactile coating

- Contrasting and non-slip walking nose

- Non-slip flooring

- Corner protection

- Railing

- Adapted door or window

- Door reversal or widening

- Sliding door

- Magnetic loop

- Vertical lifting apparatus having a platform adapted for the transport of a disabled person and inclined-displacement lifting apparatus specially designed for the movement of a disabled person.

Expenditure concerned

The expenses taken into account for the tax credit are:

- Purchase price of equipment (or materials)

- Labor costs.

Administrative or financial costs (e.g. interest) are excluded.

It's only the expenses you actually paid.

If you received financial assistance, you must deduct it.

Tax credit rate

The rate is 25% the amount of expenditure.

Expenditure ceiling

Expenditure is capped at one of the following amounts:

- €5,000 for a single person

- €10,000 for a married or former couple subject to joint taxation.

This ceiling shall be increased by €400 per dependent (€200 per child in alternating residence).

Warning

This ceiling shall be fixed for a period of 5 consecutive years. For example, for the year 2025, it relates to expenses between 1er January 2021 to December 31, 2025.

You must report the amount of expenses you paid in 2025 in the “Tax reductions and tax credits” of your statement.

Keep your proof of expenses because the tax administration can ask you for them (company invoice, seller's certificate).

If the amount of the tax credit exceeds the amount of the tax due, the excess will be returned to you.

Who can help me?

Find who can answer your questions in your region

For general information

By phone:

0809 401 401

Monday to Friday from 8:30 am to 7 pm, excluding public holidays.

Free service + price call

To contact the local service managing your file

Tax department (treasury, tax department...)

Tax credit for expenditure on aid to persons (Article 200c A)

List of equipment specially designed for the elderly or disabled (Article 18b)

Online service

Online service

FAQ

Service Public

Service Public

Service Public

Ministry of Finance

Ministry of Finance

Ministry of Finance

National Housing Agency (Anah)